The Walt Disney Company, a titan in the entertainment industry, recently released its earnings report, showcasing a remarkable performance that has captured the attention of investors and analysts alike. This report not only highlights the company’s resilience in a rapidly changing market but also underscores its strategic initiatives that have contributed to its robust financial health. Disney’s ability to adapt to evolving consumer preferences, particularly in the realms of streaming and experiential entertainment, has positioned it favorably against competitors.

The earnings report serves as a testament to Disney’s enduring brand strength and its capacity to innovate in an increasingly competitive landscape. In the context of a post-pandemic recovery, Disney’s earnings report reflects a broader trend of resurgence within the entertainment sector. As audiences return to theaters and theme parks, Disney has capitalized on this momentum, leveraging its diverse portfolio of assets.

The report reveals not just numbers but a narrative of recovery and growth, illustrating how Disney has navigated challenges while seizing new opportunities. This article delves into the specifics of Disney’s financial performance, examining revenue streams, the impact of its streaming service, and the overall market response to its latest results.

Key Takeaways

- Disney reported strong earnings driven by robust revenue and profit growth.

- Disney+ streaming service significantly contributed to the company’s improved financial performance.

- Theme parks and studio divisions showed solid recovery and growth in the latest quarter.

- Disney’s stock outperformed many industry peers following the earnings announcement.

- Investors reacted positively, with optimistic outlooks for Disney’s future stock price.

Analysis of Disney’s Revenue and Profit Growth

Disney’s latest earnings report reveals a significant uptick in both revenue and profit, driven by a combination of strategic investments and a rebound in consumer spending. The company reported a year-over-year revenue increase that surpassed analysts’ expectations, showcasing a strong recovery trajectory. Key segments such as media networks, parks, experiences, and direct-to-consumer offerings have all contributed to this growth.

For instance, the parks division saw a remarkable surge in attendance as travel restrictions eased, leading to increased spending per guest on food, merchandise, and experiences. Moreover, Disney’s profitability has also seen a notable enhancement, with operating margins improving across various segments. The company’s ability to manage costs effectively while maximizing revenue opportunities has played a crucial role in this growth.

For example, Disney’s focus on premium experiences at its theme parks has not only attracted more visitors but also encouraged higher spending per capita. This strategic approach has allowed Disney to maintain healthy profit margins even amidst rising operational costs, demonstrating its adeptness at navigating complex market dynamics.

Impact of Disney+ Streaming Service on Earnings

Disney+ has emerged as a pivotal player in Disney’s overall earnings strategy, significantly influencing the company’s financial landscape. Launched in late 2019, the streaming service quickly gained traction, amassing millions of subscribers within its first year. The latest earnings report highlights that Disney+ continues to be a major driver of revenue growth, contributing substantially to the direct-to-consumer segment.

The service’s diverse content library, which includes beloved classics and original programming from franchises like Marvel and Star Wars, has proven to be a magnet for subscribers. The financial implications of Disney+ extend beyond mere subscription fees; they also encompass advertising revenue and potential partnerships. As the platform matures, Disney is exploring various monetization strategies that could further enhance its earnings potential.

For instance, the introduction of ad-supported tiers is expected to attract a broader audience while generating additional revenue streams. Furthermore, the integration of Disney+ with other Disney offerings—such as theme park experiences and merchandise—creates synergistic opportunities that can amplify overall profitability.

Discussion of Disney’s Theme Park and Studio Performance

Disney’s theme parks have long been a cornerstone of its business model, and recent performance metrics indicate a robust recovery following pandemic-related closures. The parks division reported record attendance figures during peak seasons, driven by pent-up demand for travel and leisure activities. This resurgence is not merely about foot traffic; it reflects a strategic emphasis on enhancing guest experiences through new attractions and immersive environments.

For example, the opening of new rides based on popular franchises has drawn significant crowds, resulting in increased spending on food and merchandise. In addition to theme parks, Disney’s studio performance has also been noteworthy. The company has successfully released several blockbuster films that have resonated with audiences globally.

Titles from the Marvel Cinematic Universe and animated features have not only performed well at the box office but have also contributed to ancillary revenue streams through merchandise sales and home entertainment. The synergy between Disney’s film releases and its streaming service further amplifies this success; films released in theaters often find their way to Disney+ shortly thereafter, driving subscriber growth while keeping audiences engaged with the brand.

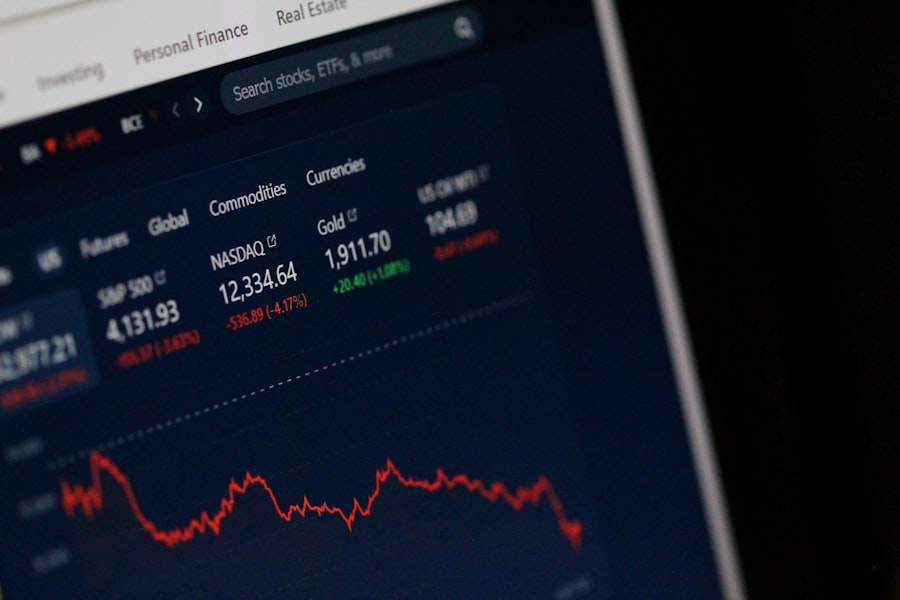

Comparison of Disney’s Stock Performance to Industry Peers

| Date | Opening Price | Closing Price | Highest Price | Lowest Price | Volume |

|---|---|---|---|---|---|

| 2024-06-20 | 95.50 | 97.20 | 98.00 | 95.00 | 12,500,000 |

| 2024-06-19 | 94.00 | 95.40 | 96.00 | 93.50 | 10,800,000 |

| 2024-06-18 | 93.20 | 94.10 | 94.50 | 92.80 | 9,750,000 |

| 2024-06-17 | 92.00 | 93.00 | 93.50 | 91.50 | 11,200,000 |

| 2024-06-16 | 91.50 | 92.10 | 92.80 | 90.90 | 10,000,000 |

When evaluating Disney’s stock performance in relation to its industry peers, it becomes evident that the company has maintained a competitive edge despite market fluctuations. While many entertainment stocks experienced volatility due to changing consumer behaviors and economic uncertainties, Disney’s diversified portfolio has provided a buffer against such challenges. Compared to other major players in the entertainment sector—such as Netflix and Comcast—Disney’s stock has shown resilience, buoyed by strong earnings reports and positive market sentiment.

Moreover, Disney’s strategic investments in technology and content creation have positioned it favorably against competitors who may struggle with similar challenges. For instance, while Netflix has faced subscriber growth challenges in recent quarters, Disney’s multifaceted approach—combining traditional media with innovative streaming solutions—has allowed it to capture market share effectively. This comparative analysis underscores not only Disney’s strong financial performance but also its strategic foresight in navigating an evolving industry landscape.

Investor Reaction to Disney’s Earnings Report

The investor reaction to Disney’s latest earnings report has been overwhelmingly positive, reflecting confidence in the company’s strategic direction and financial health. Following the announcement, Disney’s stock price experienced an uptick as investors responded favorably to the strong revenue growth and improved profitability metrics. Analysts have lauded the company’s ability to adapt to changing market conditions while maintaining its core brand identity—a factor that resonates well with long-term investors seeking stability amid uncertainty.

Furthermore, investor sentiment is bolstered by Disney’s commitment to innovation and expansion within its streaming service. As competition intensifies in the streaming space, investors are keenly aware of the importance of subscriber growth and content diversification. The positive reception of new original programming on Disney+ has further fueled optimism among investors regarding future earnings potential.

This enthusiasm is reflected not only in stock price movements but also in increased trading volumes as investors position themselves for anticipated growth.

Future Outlook for Disney Stock Price

Looking ahead, the future outlook for Disney’s stock price appears promising based on several key factors that are likely to influence its trajectory. First and foremost is the continued expansion of Disney+, which is expected to play a critical role in driving revenue growth over the coming years. As the platform continues to evolve with new content offerings and potential international expansions, analysts predict that subscriber numbers will rise significantly, contributing positively to overall earnings.

Additionally, the recovery of Disney’s theme parks is expected to sustain momentum as travel trends continue to favor leisure activities. With ongoing investments in park infrastructure and new attractions designed to enhance guest experiences, Disney is well-positioned to capitalize on increased consumer spending in this sector. Furthermore, as global markets stabilize post-pandemic, there is potential for international parks—such as those in Shanghai and Paris—to contribute even more significantly to revenue streams.

Conclusion and Summary of Disney’s Earnings Report

Disney’s latest earnings report encapsulates a narrative of resilience and strategic growth within an ever-evolving entertainment landscape. The company’s ability to leverage its diverse portfolio—from theme parks to streaming services—has resulted in impressive revenue and profit growth that outpaces many industry peers. The impact of Disney+ cannot be overstated; it serves as both a revenue generator and a vital component of the company’s long-term strategy.

As investor sentiment remains buoyant following this strong performance, the outlook for Disney stock appears favorable. With continued investments in content creation and park enhancements alongside an expanding subscriber base for its streaming service, Disney is poised for sustained growth in the coming years. This multifaceted approach not only reinforces Disney’s position as a leader in the entertainment industry but also highlights its commitment to innovation and adaptability in an increasingly competitive market environment.