The real estate market is a complex and dynamic environment influenced by a multitude of factors, including economic conditions, demographic trends, and government policies. At its core, the real estate market can be divided into several segments, such as residential, commercial, industrial, and agricultural properties. Each segment operates under its own set of rules and market dynamics, making it essential for investors to understand the nuances of the specific sector they are interested in.

For instance, the residential market is often driven by factors such as population growth, employment rates, and interest rates, while the commercial market may be more sensitive to business cycles and consumer spending patterns. In addition to understanding the different segments of the market, investors must also be aware of local market conditions. Real estate is inherently local; what may be true for one city or neighborhood may not hold for another.

Factors such as zoning laws, school district quality, and local amenities can significantly impact property values. For example, a neighborhood that is undergoing revitalization may present lucrative opportunities for investors, while an area with declining infrastructure may pose risks. Therefore, conducting thorough research and analysis of local market trends is crucial for making informed investment decisions.

Key Takeaways

- Grasping market dynamics is essential for successful real estate investing.

- Recognizing high-return properties helps maximize investment profits.

- Using various financing methods can enhance purchasing power and flexibility.

- Effective property management ensures sustained income and asset value.

- Staying informed on tax benefits and market trends aids in risk reduction and portfolio growth.

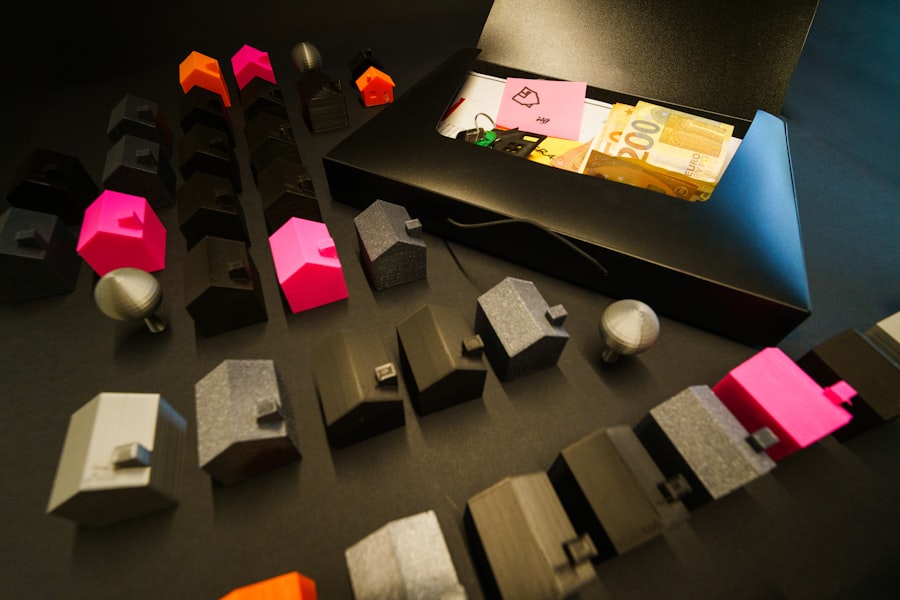

Identifying Profitable Investment Opportunities

Identifying profitable investment opportunities in real estate requires a keen eye for potential and a thorough understanding of market dynamics. One effective strategy is to look for undervalued properties that have the potential for appreciation. This could involve purchasing homes in up-and-coming neighborhoods where prices are expected to rise due to new developments or infrastructure improvements.

For instance, an investor might find a single-family home in a neighborhood that is experiencing an influx of new businesses and residents, indicating a potential increase in demand. Another approach is to consider distressed properties that require renovation or rehabilitation. These properties can often be acquired at a lower price point, allowing investors to add value through improvements.

For example, an investor might purchase a fixer-upper in a desirable location, invest in renovations to modernize the property, and then either sell it for a profit or rent it out at a higher rate. This strategy not only enhances the property’s value but also contributes to the overall improvement of the neighborhood.

Leveraging Financing Options

Financing plays a pivotal role in real estate investment, as it can significantly affect an investor’s ability to acquire properties and maximize returns. Traditional financing options include mortgages from banks or credit unions, which typically require a down payment and come with varying interest rates based on creditworthiness. However, investors should also explore alternative financing methods such as private lenders, hard money loans, or even partnerships with other investors.

Each option has its own set of advantages and disadvantages that must be carefully weighed. For instance, hard money loans can provide quick access to capital for investors looking to purchase properties that require immediate attention. These loans are typically secured by the property itself and are often easier to obtain than traditional financing, albeit at higher interest rates.

On the other hand, forming partnerships with other investors can allow individuals to pool resources and share risks while benefiting from collective expertise. By leveraging various financing options strategically, investors can enhance their purchasing power and increase their chances of success in the competitive real estate market.

Implementing Property Management Strategies

Effective property management is crucial for maintaining the value of real estate investments and ensuring a steady stream of income. Investors must decide whether to manage properties themselves or hire professional property management companies. Self-management can save costs but requires significant time and effort, including handling tenant relations, maintenance issues, and legal compliance.

For example, an investor who manages their own rental properties must be prepared to respond promptly to tenant requests and ensure that the property remains in good condition. On the other hand, hiring a property management company can alleviate these burdens but comes at a cost. A professional management firm can handle everything from tenant screening and lease agreements to maintenance and rent collection.

This allows investors to focus on other aspects of their investment strategy while ensuring that their properties are well-managed. Additionally, experienced property managers often have access to resources and networks that can enhance tenant retention and reduce vacancy rates.

Utilizing Tax Benefits and Incentives

| Metric | Description | Typical Value/Range | Importance |

|---|---|---|---|

| Cap Rate (Capitalization Rate) | Annual net operating income divided by property purchase price | 4% – 10% | Measures property’s potential return |

| Cash-on-Cash Return | Annual pre-tax cash flow divided by total cash invested | 8% – 12% | Evaluates cash income relative to cash invested |

| Gross Rent Multiplier (GRM) | Property price divided by gross annual rental income | 4 – 12 | Quick estimate of property value vs rental income |

| Loan-to-Value Ratio (LTV) | Loan amount divided by property value | 60% – 80% | Indicates leverage and financing risk |

| Occupancy Rate | Percentage of rented units in a property | 90% – 98% | Reflects property income stability |

| Operating Expense Ratio | Operating expenses divided by effective gross income | 30% – 50% | Shows efficiency of property management |

| Internal Rate of Return (IRR) | Annualized rate of return over investment holding period | 10% – 20% | Measures overall profitability |

| Debt Service Coverage Ratio (DSCR) | Net operating income divided by total debt service | 1.2 – 1.5 | Assesses ability to cover debt payments |

Real estate investment offers various tax benefits that can significantly enhance an investor’s overall return on investment. One of the most notable advantages is the ability to deduct mortgage interest payments from taxable income. This deduction can lead to substantial savings over time, especially in the early years of a mortgage when interest payments are typically higher.

Furthermore, property depreciation allows investors to write off a portion of the property’s value each year against their taxable income, providing additional tax relief. In addition to these deductions, many governments offer incentives for real estate investors aimed at stimulating economic growth or encouraging specific types of development. For example, some areas may provide tax credits for rehabilitating historic properties or investing in low-income housing projects.

Investors should stay informed about local tax laws and incentives that may apply to their investments, as these can significantly impact overall profitability.

Diversifying Investment Portfolio

Diversification is a fundamental principle of investing that helps mitigate risk while maximizing potential returns. In real estate, this can be achieved by investing in different types of properties across various geographic locations. For instance, an investor might choose to invest in both residential rental properties and commercial office spaces to balance their portfolio.

This strategy allows them to benefit from different market cycles; while residential properties may perform well during economic downturns due to consistent demand for housing, commercial properties may thrive during periods of economic growth. Moreover, diversifying within the residential sector itself can also be beneficial. An investor might consider single-family homes, multi-family units, and vacation rentals as part of their portfolio.

Each type of property comes with its own set of risks and rewards; for example, vacation rentals may offer higher short-term returns but can also be subject to seasonal fluctuations in demand. By spreading investments across various property types and locations, investors can reduce their exposure to any single market downturn while capitalizing on multiple revenue streams.

Monitoring Market Trends and Economic Indicators

Staying informed about market trends and economic indicators is essential for making strategic investment decisions in real estate. Key indicators such as employment rates, inflation levels, and consumer confidence can provide valuable insights into the overall health of the economy and its potential impact on the real estate market. For instance, rising employment rates typically correlate with increased demand for housing as more individuals seek homes in stable job markets.

Additionally, monitoring local market trends such as housing inventory levels, average days on the market, and price appreciation rates can help investors identify emerging opportunities or potential challenges. For example, if inventory levels are low while demand remains high in a particular area, it may signal an opportune time to invest before prices escalate further. Conversely, if there is an oversupply of homes leading to longer selling times and stagnant prices, it may be wise to hold off on new acquisitions until conditions improve.

Mitigating Risks and Protecting Investments

Investing in real estate inherently involves risks; however, there are several strategies that investors can employ to mitigate these risks effectively. One fundamental approach is conducting thorough due diligence before making any investment decisions. This includes researching property history, analyzing comparable sales data, and assessing potential environmental issues that could affect property value or usability.

Another critical aspect of risk management is maintaining adequate insurance coverage for properties. Investors should consider various types of insurance policies tailored to their specific needs—such as landlord insurance for rental properties or liability insurance for commercial spaces—to protect against unforeseen events like natural disasters or tenant-related incidents. Additionally, establishing an emergency fund can provide a financial buffer against unexpected expenses or vacancies that may arise during ownership.

By implementing these strategies and remaining vigilant about market conditions and property performance, investors can safeguard their investments while positioning themselves for long-term success in the ever-evolving real estate landscape.