QuantumScape, a company founded in 2010, has emerged as a frontrunner in the development of solid-state battery technology, which is poised to revolutionize the electric vehicle (EV) market. The company went public in 2020 through a merger with a special purpose acquisition company (SPAC), creating significant buzz among investors and industry experts alike. QuantumScape’s innovative approach to battery technology has attracted considerable attention, particularly as the automotive industry shifts towards electrification and sustainability.

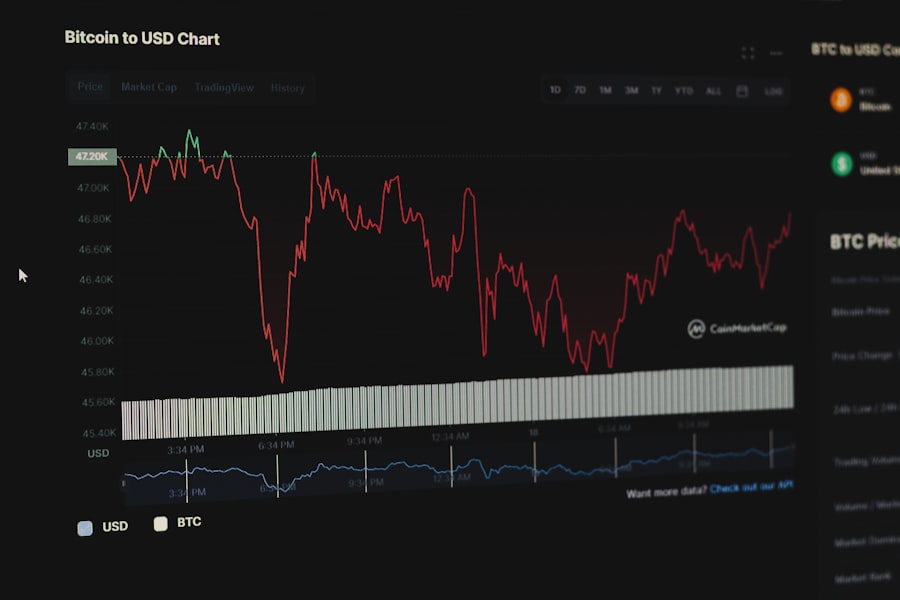

The stock has experienced volatility since its debut, reflecting both the excitement surrounding its potential and the inherent risks associated with emerging technologies. Investors are drawn to QuantumScape not only for its groundbreaking technology but also for its ambitious vision of transforming energy storage solutions. The company’s solid-state batteries promise to deliver higher energy density, faster charging times, and enhanced safety compared to traditional lithium-ion batteries.

As the demand for electric vehicles continues to surge, driven by environmental concerns and government incentives, QuantumScape’s stock has become a focal point for those looking to capitalize on the EV revolution. However, understanding the intricacies of the company’s technology, market position, and future prospects is essential for making informed investment decisions.

Key Takeaways

- QuantumScape focuses on developing solid-state battery technology with significant potential to revolutionize the EV industry.

- The company has secured key partnerships and investments that bolster its position in the competitive electric vehicle market.

- Investing in QuantumScape carries risks due to technological challenges and market uncertainties.

- Analysts provide mixed recommendations, reflecting both optimism about growth and caution about execution risks.

- QuantumScape’s growth strategy centers on innovation and scaling production to capitalize on future EV demand.

The Potential of Solid-State Batteries

Solid-state batteries represent a significant advancement over conventional lithium-ion batteries, primarily due to their use of solid electrolytes instead of liquid ones. This fundamental shift allows for greater energy density, which translates into longer driving ranges for electric vehicles. For instance, QuantumScape claims that its solid-state batteries can achieve energy densities exceeding 1,000 Wh/L, compared to approximately 600 Wh/L for current lithium-ion batteries.

This increase in energy density could enable electric vehicles to travel much farther on a single charge, addressing one of the primary concerns of potential EV buyers: range anxiety. Moreover, solid-state batteries are inherently safer than their liquid counterparts. Traditional lithium-ion batteries are prone to thermal runaway, which can lead to fires or explosions under certain conditions.

In contrast, solid-state batteries eliminate the flammable liquid electrolyte, significantly reducing the risk of such incidents. This safety advantage is particularly appealing to automakers and consumers alike, as it aligns with the growing emphasis on safety in vehicle design. Additionally, solid-state batteries have the potential for faster charging times, which could further enhance the convenience of electric vehicle ownership.

QuantumScape’s Partnerships and Investments

QuantumScape has strategically aligned itself with key players in the automotive and technology sectors to bolster its position in the market. One of its most notable partnerships is with Volkswagen, which has invested heavily in QuantumScape and is collaborating on the development of solid-state battery technology for electric vehicles. This partnership not only provides QuantumScape with substantial financial backing but also grants access to Volkswagen’s extensive automotive expertise and manufacturing capabilities.

The collaboration aims to bring solid-state batteries to market by 2025, a timeline that reflects both companies’ commitment to advancing EV technology. In addition to Volkswagen, QuantumScape has attracted investments from other prominent firms and venture capitalists, further validating its business model and technological advancements. The company’s ability to secure funding from reputable sources underscores investor confidence in its potential to disrupt the battery market.

Furthermore, these partnerships facilitate knowledge sharing and innovation, allowing QuantumScape to leverage external expertise while focusing on its core competencies in battery development. As the company continues to forge alliances within the industry, it positions itself as a key player in the transition towards sustainable energy solutions.

Risks and Challenges of Investing in QuantumScape

Despite its promising technology and strategic partnerships, investing in QuantumScape carries inherent risks that potential investors must carefully consider. One of the primary challenges is the competitive landscape of the battery industry. Numerous companies are vying for dominance in the solid-state battery space, including established players like Panasonic and emerging startups.

This competition could hinder QuantumScape’s ability to capture market share and achieve profitability in a timely manner. Additionally, the commercialization of solid-state batteries is fraught with technical hurdles. While QuantumScape has made significant strides in developing its technology, scaling production to meet demand presents a formidable challenge.

The transition from laboratory prototypes to mass production involves overcoming various engineering and manufacturing obstacles. Investors should be aware that delays or setbacks in this process could adversely impact the company’s stock performance and overall market perception.

QuantumScape’s Competitive Advantage in the EV Market

| Metric | Value | Date |

|---|---|---|

| Stock Ticker | QS | 2024-06 |

| Market Capitalization | 8.5 Billion | 2024-06 |

| Share Price | 12.45 | 2024-06-10 |

| 52-Week High | 28.00 | 2023-12 |

| 52-Week Low | 9.50 | 2024-05 |

| Price to Earnings (P/E) Ratio | N/A (Negative Earnings) | 2024-06 |

| Revenue (TTM) | 15 Million | 2024-03 |

| Net Income (TTM) | -150 Million | 2024-03 |

| Shares Outstanding | 700 Million | 2024-06 |

QuantumScape’s competitive advantage lies in its proprietary technology and its focus on solid-state batteries specifically designed for electric vehicles. Unlike many competitors that are still refining their lithium-ion technologies or exploring alternative chemistries, QuantumScape has concentrated its efforts on developing a product that addresses the unique challenges faced by EV manufacturers. This specialization allows QuantumScape to differentiate itself in a crowded market and position itself as a leader in solid-state battery innovation.

Moreover, the company’s commitment to sustainability aligns with broader industry trends towards environmentally friendly solutions. As consumers become increasingly conscious of their carbon footprints, automakers are under pressure to adopt greener technologies. QuantumScape’s solid-state batteries not only offer improved performance but also promise a lower environmental impact during production and disposal compared to traditional batteries.

This alignment with consumer preferences enhances QuantumScape’s appeal as an investment opportunity within the rapidly evolving EV landscape.

Analysts’ Recommendations and Forecasts for QuantumScape Stock

Analysts have expressed a range of opinions regarding QuantumScape’s stock performance and future prospects. Some analysts are bullish on the company’s potential, citing its innovative technology and strategic partnerships as key drivers for growth. They argue that as electric vehicle adoption accelerates globally, QuantumScape is well-positioned to capture significant market share in the battery sector.

Price targets set by optimistic analysts often reflect this belief, suggesting substantial upside potential for investors willing to take on risk. Conversely, more cautious analysts highlight the uncertainties surrounding QuantumScape’s commercialization timeline and competitive landscape. They emphasize that while the technology shows promise, it remains unproven at scale.

These analysts often recommend a more conservative approach to investing in QuantumScape stock, advising potential investors to closely monitor developments within the company and the broader battery market before making significant commitments. This divergence in analyst opinions underscores the complexity of investing in emerging technologies like those offered by QuantumScape.

QuantumScape’s Growth Strategy and Future Outlook

QuantumScape’s growth strategy revolves around accelerating the development and commercialization of its solid-state battery technology while expanding its manufacturing capabilities. The company aims to establish large-scale production facilities that can meet the anticipated demand from automakers seeking advanced battery solutions for their electric vehicles. By investing in state-of-the-art manufacturing processes and technologies, QuantumScape seeks to ensure that it can deliver high-quality products efficiently and cost-effectively.

Furthermore, QuantumScape is actively exploring opportunities for collaboration beyond its partnership with Volkswagen. The company recognizes that forming alliances with other automakers and technology firms can enhance its research and development efforts while broadening its market reach. As it continues to innovate and refine its battery technology, QuantumScape is also focused on building a robust supply chain that can support its growth ambitions.

This multifaceted approach positions QuantumScape for long-term success as it navigates the evolving landscape of electric vehicle technology.

Is QuantumScape Stock a Good Investment?

Investing in QuantumScape stock presents both exciting opportunities and significant risks. The company’s pioneering work in solid-state battery technology positions it at the forefront of an industry poised for explosive growth as electric vehicles gain traction worldwide. However, potential investors must weigh these opportunities against the challenges inherent in bringing new technologies to market and competing against established players.

Ultimately, whether QuantumScape stock is a good investment depends on individual risk tolerance and investment strategy. For those who believe in the transformative potential of solid-state batteries and are willing to navigate the uncertainties of an emerging market, QuantumScape may represent an attractive opportunity. Conversely, more risk-averse investors may prefer to wait until the company demonstrates consistent progress toward commercialization and profitability before committing capital.

As with any investment decision, thorough research and careful consideration of market dynamics are essential for making informed choices regarding QuantumScape stock.