SLV stock represents the iShares Silver Trust, an exchange-traded fund (ETF) that aims to track the price of silver bullion. Launched in 2006, SLV provides investors with a convenient way to gain exposure to silver without the need to physically hold the metal. The fund is designed to reflect the performance of silver prices, making it an attractive option for those looking to invest in precious metals.

The trust holds physical silver bars in secure vaults, and each share of SLV corresponds to a specific amount of silver, allowing investors to participate in the silver market with relative ease. Investing in SLV stock can be particularly appealing during times of economic uncertainty or inflation, as silver is often viewed as a safe-haven asset. Unlike stocks or bonds, silver has intrinsic value and has been used as a form of currency and a store of value for centuries.

The demand for silver is not only driven by its investment appeal but also by its industrial applications, which include electronics, solar panels, and medical devices. This dual demand—both as an investment and as an industrial commodity—adds layers of complexity to the dynamics influencing SLV stock.

Key Takeaways

- SLV stock tracks the price of silver and is influenced by global economic factors.

- Recent performance shows volatility driven by market demand and geopolitical events.

- Key factors affecting SLV include silver supply, inflation rates, and currency fluctuations.

- Technical analysis highlights important support and resistance levels for trading decisions.

- Fundamental analysis and market sentiment suggest cautious optimism for SLV’s future growth.

Recent Performance of SLV Stock

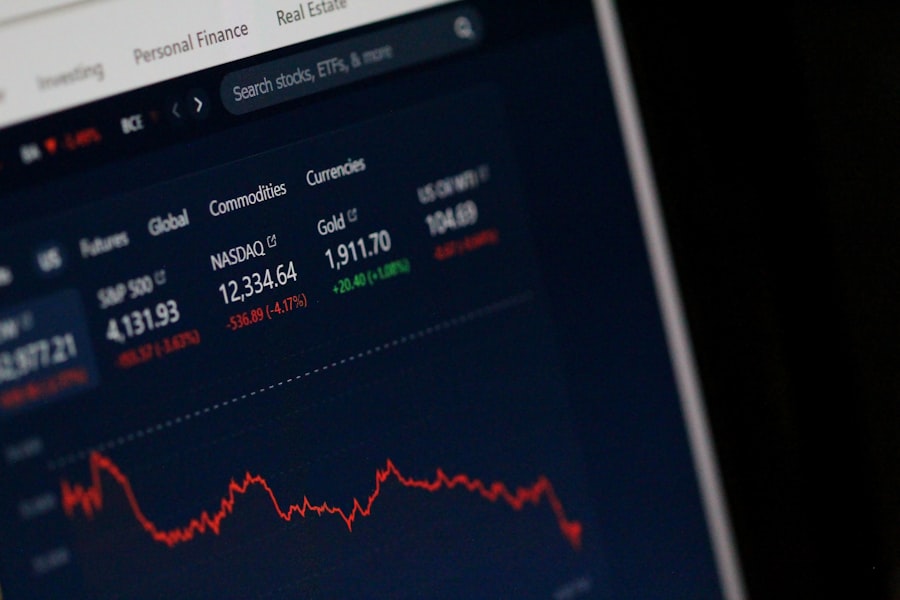

In recent months, SLV stock has experienced notable fluctuations, reflecting broader trends in the commodities market and investor sentiment towards precious metals. As of late 2023, SLV has seen periods of volatility, with prices responding to macroeconomic indicators such as inflation rates, interest rate changes, and geopolitical tensions. For instance, during times when inflationary pressures have surged, SLV stock has often rallied as investors flock to silver as a hedge against currency devaluation.

Conversely, when interest rates rise, the opportunity cost of holding non-yielding assets like silver increases, leading to potential declines in SLV stock prices. The performance of SLV stock is also closely tied to the overall performance of silver prices in the global market. In recent months, silver has seen price movements influenced by supply chain disruptions and changes in mining output due to environmental regulations and labor issues.

For example, if major silver-producing countries face political instability or natural disasters that disrupt mining operations, this can lead to supply shortages and subsequently drive up prices. Investors closely monitor these developments as they can have immediate effects on SLV stock performance.

Factors Influencing SLV Stock Price

Several key factors influence the price of SLV stock, with market dynamics playing a crucial role. One significant factor is the global demand for silver, which is driven by both investment and industrial needs. The industrial sector accounts for a substantial portion of silver consumption; thus, trends in manufacturing and technology can significantly impact demand.

For instance, the growing adoption of electric vehicles and renewable energy technologies has increased the demand for silver in photovoltaic cells used in solar panels. As these industries expand, they create upward pressure on silver prices, which in turn affects SLV stock. Another critical factor is the monetary policy set by central banks around the world.

When central banks adopt accommodative monetary policies—such as lowering interest rates or implementing quantitative easing—investors often seek out precious metals like silver as a hedge against inflation and currency depreciation. Conversely, tightening monetary policy can lead to a decrease in demand for non-yielding assets like silver, negatively impacting SLV stock prices. Additionally, geopolitical events can create uncertainty in financial markets, prompting investors to flock to safe-haven assets like silver, further influencing SLV’s price movements.

Technical Analysis of SLV Stock

Technical analysis of SLV stock involves examining historical price movements and trading volumes to identify patterns that may predict future price behavior. Traders often utilize various indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to gauge market sentiment and potential entry or exit points. For instance, if SLV stock consistently trades above its 50-day moving average, it may indicate a bullish trend, suggesting that investors are optimistic about future price increases.

Moreover, chart patterns such as head-and-shoulders or double tops can provide insights into potential reversals or continuations in price trends. For example, if SLV stock forms a double bottom pattern after a downtrend, it may signal a reversal point where buyers are stepping in at lower prices. Volume analysis is also crucial; an increase in trading volume accompanying a price rise can indicate strong buying interest and validate the upward movement.

Conversely, if prices rise on low volume, it may suggest a lack of conviction among buyers.

Fundamental Analysis of SLV Stock

| Date | Opening Price | Closing Price | High | Low | Volume |

|---|---|---|---|---|---|

| 2024-06-20 | 22.45 | 22.70 | 22.85 | 22.40 | 1,200,000 |

| 2024-06-19 | 22.30 | 22.50 | 22.60 | 22.25 | 1,100,000 |

| 2024-06-18 | 22.10 | 22.35 | 22.40 | 22.05 | 1,300,000 |

| 2024-06-17 | 22.00 | 22.15 | 22.20 | 21.95 | 1,000,000 |

| 2024-06-16 | 21.85 | 22.05 | 22.10 | 21.80 | 950,000 |

Fundamental analysis of SLV stock involves evaluating the underlying factors that affect the value of silver and its corresponding ETF. This includes assessing supply and demand dynamics within the silver market, examining production costs for mining companies, and understanding macroeconomic indicators that influence investor behavior. For instance, if mining costs rise due to increased energy prices or regulatory changes, this could impact the profitability of silver production and ultimately affect supply levels.

Additionally, macroeconomic indicators such as inflation rates, employment data, and GDP growth can provide insights into the overall economic environment that influences investor sentiment towards precious metals. A robust economy may lead to decreased demand for safe-haven assets like silver as investors shift their focus towards equities or other growth-oriented investments. Conversely, during economic downturns or periods of high inflation, demand for SLV stock may increase as investors seek stability in tangible assets.

Comparison with Other Precious Metals Stocks

When evaluating SLV stock, it is essential to compare it with other precious metals stocks such as gold ETFs (e.g., GLD) or platinum ETFs (e.g., PPLT). Each precious metal has unique characteristics that influence its market behavior. Gold is often viewed as the ultimate safe-haven asset and tends to attract significant investment during times of economic uncertainty.

In contrast, silver’s dual role as both an investment and an industrial metal can lead to different price dynamics compared to gold. For example, during periods of economic recovery when industrial demand surges, silver may outperform gold due to its extensive use in manufacturing and technology sectors. Conversely, during times of heightened geopolitical risk or financial instability, gold may see greater inflows as investors prioritize safety over industrial utility.

Understanding these differences can help investors make informed decisions about their portfolios and how much exposure they want to allocate to SLV versus other precious metals.

Market Sentiment and SLV Stock Price

Market sentiment plays a pivotal role in determining the price movements of SLV stock. Investor psychology can lead to rapid shifts in buying or selling behavior based on news events or broader economic indicators. For instance, if there are reports indicating rising inflation or geopolitical tensions—such as conflicts in major mining regions—investors may react by increasing their positions in SLV stock as they seek protection against potential economic fallout.

Social media platforms and online trading forums have also amplified the impact of market sentiment on SLV stock prices. Retail investors can quickly mobilize around specific narratives or trends that influence buying behavior. For example, during periods when retail trading activity surges—often driven by social media discussions—SLV stock may experience significant price movements that do not necessarily align with traditional fundamental or technical analysis.

This phenomenon underscores the importance of understanding market sentiment as a driving force behind price fluctuations.

Future Outlook for SLV Stock Price

Looking ahead, the future outlook for SLV stock price will likely be shaped by several interrelated factors including macroeconomic conditions, technological advancements in industries utilizing silver, and shifts in investor sentiment towards precious metals. Analysts predict that if inflation remains elevated or if economic uncertainties persist—such as potential recessions or geopolitical conflicts—demand for safe-haven assets like silver could continue to rise. Furthermore, advancements in technology that increase the use of silver in renewable energy applications could bolster long-term demand for the metal.

As countries transition towards greener energy solutions and electric vehicles become more mainstream, the industrial demand for silver may see significant growth. This could create upward pressure on SLV stock prices over time. In conclusion, while predicting exact price movements is inherently uncertain due to the myriad factors at play in financial markets, understanding these dynamics can provide valuable insights for investors considering exposure to SLV stock.

The interplay between supply and demand fundamentals, technical indicators, market sentiment, and broader economic conditions will continue to shape the trajectory of this precious metals ETF in the years ahead.