SOXL, or the Direxion Daily Semiconductor Bull 3X Shares, is an exchange-traded fund (ETF) that seeks to provide investors with leveraged exposure to the semiconductor sector. Specifically, it aims to deliver three times the daily performance of the PHLX Semiconductor Sector Index. This means that if the index rises by 1% on a given day, SOXL is designed to increase by approximately 3%.

Conversely, if the index falls by 1%, SOXL would likely decrease by about 3%. This leveraged approach makes SOXL an attractive option for traders looking to capitalize on short-term movements in the semiconductor market, but it also introduces a higher level of risk. The semiconductor industry is a critical component of the global economy, underpinning a wide array of technologies from smartphones to advanced computing systems.

As demand for semiconductors continues to grow, driven by trends such as artificial intelligence, 5G technology, and the Internet of Things (IoT), SOXL has garnered attention from both retail and institutional investors. However, potential investors should be aware that while SOXL offers the potential for significant returns, it also carries substantial risks due to its leveraged nature and the inherent volatility of the semiconductor sector.

Key Takeaways

- SOXL is a leveraged ETF focused on semiconductor stocks, offering amplified exposure to the sector.

- Its historical performance shows high volatility with significant gains during semiconductor uptrends.

- SOXL’s price is influenced by semiconductor industry trends, technological advancements, and market demand.

- Current market trends indicate growing demand for semiconductors, impacting SOXL’s short-term outlook positively.

- Analysts highlight both high growth potential and risks due to market volatility, recommending cautious investment strategies.

Historical Performance of SOXL Stock

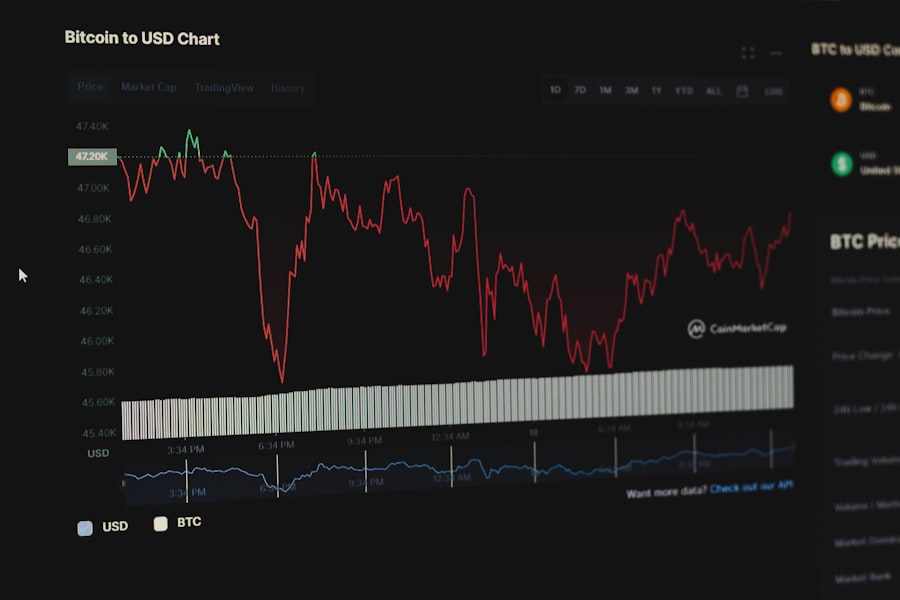

The historical performance of SOXL stock has been marked by significant volatility, reflecting both the nature of leveraged ETFs and the semiconductor industry’s cyclical trends. Since its inception in 2010, SOXL has experienced periods of remarkable growth, particularly during bullish market phases when semiconductor stocks have surged. For instance, in 2020 and 2021, as the world grappled with the COVID-19 pandemic, demand for semiconductors skyrocketed due to increased reliance on technology for remote work and entertainment.

During this period, SOXL saw its price soar, delivering impressive returns for investors who timed their entries well. However, this performance has not been without its downturns. The semiconductor sector is notoriously cyclical, influenced by factors such as supply chain disruptions, changes in consumer demand, and geopolitical tensions.

For example, in early 2022, SOXL faced significant declines as inflation concerns and interest rate hikes led to broader market sell-offs. The ETF’s leveraged structure exacerbated these losses, highlighting the risks associated with investing in such products. Investors must carefully consider these historical trends when evaluating SOXL as part of their investment strategy.

Factors Influencing SOXL Stock Price

Several key factors influence the price of SOXL stock, primarily revolving around the performance of the underlying semiconductor sector. One of the most significant drivers is technological advancement and innovation within the industry. As companies like NVIDIA, Intel, and AMD continue to push the boundaries of semiconductor technology, advancements such as smaller chip sizes and increased processing power can lead to heightened demand for their products.

This demand directly impacts the performance of the PHLX Semiconductor Sector Index and, consequently, SOXL’s price. Another critical factor is macroeconomic conditions. Economic indicators such as GDP growth rates, unemployment figures, and consumer spending can significantly affect investor sentiment towards technology stocks.

For instance, during periods of economic expansion, companies tend to invest more in technology and infrastructure, leading to increased demand for semiconductors. Conversely, during economic downturns or periods of uncertainty, companies may cut back on spending, negatively impacting semiconductor sales and subsequently affecting SOXL’s performance. Additionally, geopolitical events such as trade tensions between major economies can disrupt supply chains and impact stock prices within the sector.

Current Market Trends for SOXL Stock

As of late 2023, several market trends are shaping the landscape for SOXL stock. One prominent trend is the ongoing push towards artificial intelligence (AI) and machine learning technologies. Companies across various sectors are increasingly investing in AI capabilities, which require advanced semiconductor solutions.

This trend has led to a surge in demand for high-performance chips designed specifically for AI applications. As a result, semiconductor companies that are well-positioned to capitalize on this trend are likely to see their stock prices rise, positively influencing SOXL. Another significant trend is the global shift towards electric vehicles (EVs) and renewable energy technologies.

The transition to EVs requires sophisticated semiconductor components for battery management systems, power electronics, and autonomous driving features. As governments worldwide implement policies to promote clean energy and reduce carbon emissions, the demand for semiconductors in this sector is expected to grow substantially. This shift not only supports the broader semiconductor market but also creates opportunities for SOXL investors as companies involved in these technologies experience growth.

Analyst Predictions for SOXL Stock

| Date | Opening Price | Closing Price | High | Low | Volume |

|---|---|---|---|---|---|

| 2024-06-20 | 45.30 | 46.10 | 46.50 | 44.90 | 12,500,000 |

| 2024-06-19 | 44.80 | 45.25 | 45.60 | 44.50 | 10,800,000 |

| 2024-06-18 | 44.00 | 44.75 | 45.00 | 43.80 | 11,200,000 |

| 2024-06-17 | 43.50 | 44.10 | 44.40 | 43.20 | 9,900,000 |

| 2024-06-16 | 43.00 | 43.60 | 43.80 | 42.70 | 10,300,000 |

Analysts’ predictions for SOXL stock vary widely based on their assessments of market conditions and individual company performances within the semiconductor sector. Some analysts remain bullish on SOXL’s prospects due to the anticipated growth in demand for semiconductors driven by technological advancements and increasing adoption of AI and EV technologies. They argue that as these trends continue to unfold, leading semiconductor companies will likely experience robust earnings growth, which could translate into significant gains for SOXL investors.

Conversely, some analysts caution against potential headwinds that could impact SOXL’s performance. Concerns about rising interest rates and inflation may lead to increased volatility in equity markets overall. Additionally, any signs of a slowdown in global economic growth could dampen demand for semiconductors and negatively affect stock prices within the sector.

Analysts often emphasize the importance of monitoring macroeconomic indicators and industry-specific developments when making predictions about SOXL’s future performance.

Risks and Opportunities for Investing in SOXL Stock

Investing in SOXL stock presents both risks and opportunities that potential investors must carefully weigh. One of the primary risks associated with leveraged ETFs like SOXL is their inherent volatility. The use of leverage amplifies both gains and losses, meaning that while investors can achieve substantial returns during bullish market conditions, they can also incur significant losses during downturns.

This volatility can be particularly pronounced in the semiconductor sector due to its cyclical nature and sensitivity to macroeconomic factors. On the opportunity side, SOXL offers investors a chance to gain exposure to one of the most dynamic sectors in technology with a leveraged approach that can enhance returns. For those who are confident in their ability to time market movements effectively or who have a short-term trading strategy in mind, SOXL can be an attractive option.

Additionally, as global demand for semiconductors continues to rise due to technological advancements and emerging trends like AI and EVs, there are ample opportunities for growth within this sector that could benefit SOXL investors.

Comparison of SOXL Stock with Competing Stocks

When comparing SOXL stock with competing stocks or ETFs within the semiconductor space, several factors come into play. One notable competitor is the iShares PHLX Semiconductor ETF (SOXX), which provides exposure to a broad range of semiconductor companies but does not employ leverage. While SOXX may offer more stability due to its non-leveraged nature, it also lacks the potential for amplified returns that SOXL provides during bullish market conditions.

Another competitor is the VanEck Vectors Semiconductor ETF (SMH), which similarly tracks a diversified portfolio of semiconductor stocks without leverage. Investors seeking lower risk may prefer these non-leveraged options; however, those willing to accept higher risk for potentially greater rewards may find SOXL more appealing. The choice between these options ultimately depends on an investor’s risk tolerance and investment strategy.

Conclusion and Recommendations for Investing in SOXL Stock

In light of the various factors influencing SOXL stock’s performance—ranging from historical trends to current market dynamics—investors should approach this leveraged ETF with a clear understanding of their investment goals and risk tolerance. For those who are comfortable navigating volatility and are looking for short-term trading opportunities within a rapidly evolving sector like semiconductors, SOXL may present an attractive option. However, it is crucial for potential investors to conduct thorough research and consider diversifying their portfolios to mitigate risks associated with leveraged investments.

Monitoring macroeconomic indicators and staying informed about technological advancements within the semiconductor industry will be essential for making informed investment decisions regarding SOXL stock. Ultimately, while there are significant opportunities within this space, prudent risk management should remain a priority for anyone considering an investment in SOXL.