The stock market serves as a barometer for the overall health of an economy, reflecting the collective performance of publicly traded companies. As a dynamic entity, it is influenced by a myriad of factors ranging from economic indicators to geopolitical events. Investors, analysts, and financial institutions closely monitor these fluctuations to make informed decisions.

In recent months, the stock market has experienced significant volatility, prompting discussions about its future trajectory. This article aims to provide a comprehensive update on the current state of the stock market, examining trends, performance metrics, sector analyses, and the impact of global events. Understanding the stock market requires a grasp of its fundamental principles and the various forces that drive it.

The interplay between supply and demand, investor sentiment, and external influences creates a complex environment where prices can shift dramatically in short periods. As we delve into the current trends and performance metrics, it is essential to consider how these elements interact to shape market behavior. This exploration will not only highlight recent developments but also offer insights into potential future movements.

Key Takeaways

- The stock market is currently influenced by a mix of economic indicators and global events.

- Key sectors show varied performance, with technology and healthcare leading gains.

- Market volatility remains high due to investor uncertainty and geopolitical tensions.

- Global events, including trade policies and international conflicts, significantly impact market trends.

- Experts suggest cautious investment strategies, emphasizing diversification and long-term outlooks.

Current Trends in the Stock Market

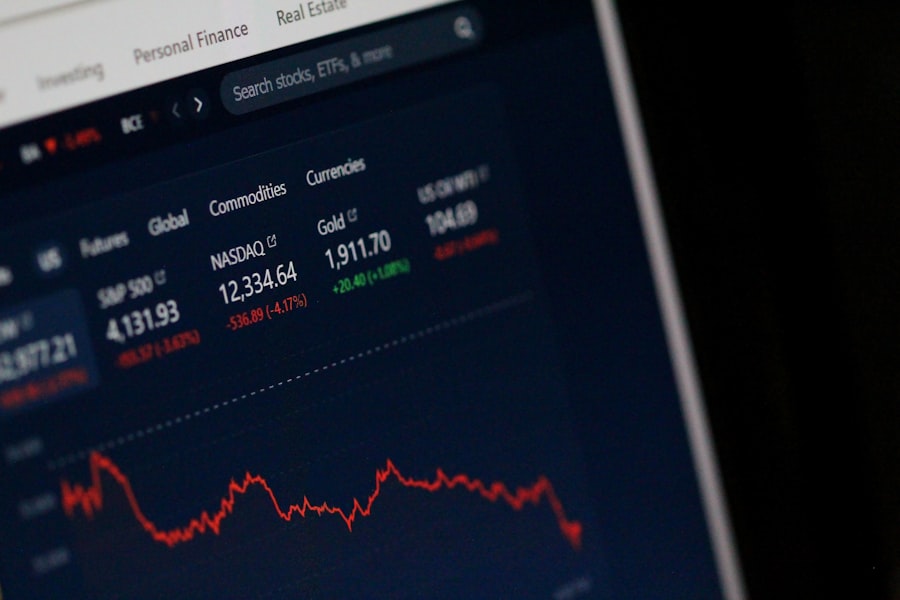

In recent months, the stock market has exhibited a mix of resilience and uncertainty. Major indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ have shown fluctuations that reflect investor sentiment and macroeconomic conditions. For instance, after a period of significant gains earlier in the year, many stocks faced downward pressure due to rising interest rates and inflation concerns.

The Federal Reserve’s monetary policy decisions have played a pivotal role in shaping these trends, as investors react to signals regarding interest rate hikes and quantitative tightening. Moreover, sector performance has varied widely, with technology stocks experiencing both surges and declines. The tech sector, which had been a primary driver of market growth during the pandemic, has faced headwinds as investors reassess valuations in light of changing economic conditions.

Conversely, sectors such as energy and financials have shown strength, buoyed by rising commodity prices and favorable interest rate environments. This divergence in sector performance underscores the complexity of the current market landscape and highlights the importance of sector-specific analysis for investors.

Analysis of Market Performance

A closer examination of market performance reveals that while some indices have struggled, others have managed to maintain upward momentum. The S&P 500, for example, has seen periods of both robust growth and sharp corrections. Year-to-date performance metrics indicate that while the index has experienced volatility, it remains above pre-pandemic levels, suggesting underlying strength in certain sectors.

However, this overall performance masks significant disparities among individual stocks and sectors. Market breadth is another critical aspect to consider when analyzing performance. The number of advancing stocks versus declining stocks provides insight into the overall health of the market.

In recent months, there have been instances where major indices have risen despite a majority of stocks declining, indicating that a handful of large-cap companies are driving gains. This phenomenon raises questions about sustainability; if only a few stocks are propelling the market higher, it may be vulnerable to corrections if those stocks falter.

Sector-wise Analysis

A sector-wise analysis reveals distinct trends that can inform investment strategies. The technology sector has been particularly noteworthy due to its rapid growth during the pandemic and subsequent adjustments as investors recalibrate their expectations. Companies involved in cloud computing, artificial intelligence, and cybersecurity have continued to attract interest; however, traditional tech giants have faced scrutiny over their valuations.

For instance, firms like Apple and Microsoft have seen fluctuations in their stock prices as they navigate supply chain challenges and regulatory scrutiny. In contrast, the energy sector has experienced a renaissance driven by rising oil prices and increased demand for renewable energy sources. Companies involved in oil exploration and production have benefited from geopolitical tensions that have disrupted supply chains.

Additionally, renewable energy firms are gaining traction as governments worldwide commit to reducing carbon emissions. This dual focus on traditional and renewable energy sources presents unique investment opportunities for those looking to capitalize on the ongoing energy transition. The financial sector has also shown resilience amid rising interest rates, which typically benefit banks through improved net interest margins.

Financial institutions are poised to gain from increased lending activity as consumers and businesses seek capital for expansion. However, potential economic slowdowns could pose risks to this sector if default rates rise or if lending slows down due to tighter credit conditions.

Impact of Global Events on Stock Market

| Stock | Price | Change (%) | Volume (Millions) | Market Cap (Billions) |

|---|---|---|---|---|

| Apple (AAPL) | 175.32 | +0.85 | 65.4 | 2800 |

| Microsoft (MSFT) | 310.45 | -0.45 | 30.2 | 2350 |

| Amazon (AMZN) | 135.67 | +1.20 | 40.1 | 1700 |

| Google (GOOGL) | 2800.12 | +0.30 | 12.5 | 1900 |

| Tesla (TSLA) | 720.50 | -1.10 | 50.3 | 900 |

Global events play a crucial role in shaping stock market dynamics. Recent geopolitical tensions, such as conflicts in Eastern Europe and trade disputes between major economies, have created uncertainty that reverberates through financial markets. Investors often react swiftly to news related to these events, leading to increased volatility as they reassess risk exposure.

For example, sanctions imposed on certain countries can disrupt supply chains and impact commodity prices, which in turn affects sectors like energy and materials. Additionally, global health crises continue to influence market behavior. The COVID-19 pandemic has underscored the interconnectedness of economies worldwide; disruptions in one region can lead to ripple effects across global markets.

As countries grapple with new variants and vaccination efforts, investor sentiment remains sensitive to developments in public health policy. The emergence of new variants can lead to renewed restrictions or changes in consumer behavior, further complicating market forecasts.

Investor Sentiment and Market Volatility

Investor sentiment is a critical driver of market volatility. Psychological factors often lead to herd behavior, where investors collectively react to news or trends without fully assessing underlying fundamentals. This can result in sharp price movements that do not necessarily reflect the intrinsic value of assets.

For instance, during periods of heightened uncertainty or fear—such as during economic downturns—investors may rush to liquidate positions, exacerbating market declines. Conversely, periods of optimism can lead to exuberance where valuations become detached from reality. The phenomenon known as “FOMO” (fear of missing out) can drive investors into overvalued stocks or sectors simply because they do not want to miss potential gains.

This cyclical nature of sentiment can create opportunities for savvy investors who are able to identify mispriced assets or sectors that are undervalued due to prevailing pessimism. Market volatility is often measured by indices such as the VIX (Volatility Index), which reflects expected future volatility based on options pricing. A rising VIX typically indicates increased uncertainty among investors, while a declining VIX suggests a more stable outlook.

Understanding these sentiment indicators can provide valuable insights into potential market movements and help investors navigate turbulent waters.

Stock Market Predictions and Forecast

Looking ahead, stock market predictions remain a topic of intense debate among analysts and economists. Various factors will influence future performance, including monetary policy decisions by central banks, inflation trends, and geopolitical developments. Many analysts anticipate that interest rates will continue to rise as central banks combat inflationary pressures; this could lead to further volatility in equity markets as borrowing costs increase for companies and consumers alike.

Sector-specific forecasts also play a crucial role in shaping investment strategies. For instance, technology stocks may face headwinds if interest rates rise significantly; however, companies that demonstrate strong fundamentals and innovative growth prospects may still attract investor interest despite broader market challenges. Conversely, sectors like energy may continue to thrive if geopolitical tensions persist or if demand for renewable energy sources accelerates.

Moreover, macroeconomic indicators such as GDP growth rates, unemployment figures, and consumer spending will provide essential context for market predictions. Analysts will closely monitor these indicators for signs of economic resilience or weakness that could impact corporate earnings and stock valuations.

Conclusion and Recommendations for Investors

As we navigate an increasingly complex stock market landscape characterized by volatility and uncertainty, investors must adopt a strategic approach grounded in thorough analysis and risk management. Diversification remains a key principle; spreading investments across various sectors can mitigate risks associated with individual stock fluctuations or sector-specific downturns. Investors should also stay informed about macroeconomic trends and global events that could impact their portfolios.

Regularly reviewing investment strategies in light of changing conditions is essential for long-term success. Engaging with financial advisors or utilizing analytical tools can provide additional insights into potential opportunities or risks within the market. Ultimately, while the stock market presents both challenges and opportunities, informed decision-making based on comprehensive analysis will be crucial for navigating its complexities successfully.

By understanding current trends, sector dynamics, and global influences, investors can position themselves strategically for future growth while managing potential risks effectively.